You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

National Debt

- Thread starter JBell

- Start date

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

No. It's all down to the management of our debt (which as you've seen by the budget deficit, we've varied in the effectiveness of) and the perception of that management.

LostKiwi

Senior Member

- Joined

- Aug 25, 2006

- Messages

- 31,351

- Reaction score

- 21,612

- Location

- Midlands / Charente-Maritime

- Your Mercedes

- '93 500SL-32, '01 W210 Estate E240 (RIP), 02 R230 SL500, 04 Smart Roadster Coupe, 11 R350CDi

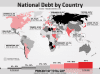

Also depends how its measured. Here's a representation of debt per capita:

UK doesn't look quite so great now....

UK doesn't look quite so great now....

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

It looks equal to many and significantly below two of the most productive economies around- Japan and Singers.

LostKiwi

Senior Member

- Joined

- Aug 25, 2006

- Messages

- 31,351

- Reaction score

- 21,612

- Location

- Midlands / Charente-Maritime

- Your Mercedes

- '93 500SL-32, '01 W210 Estate E240 (RIP), 02 R230 SL500, 04 Smart Roadster Coupe, 11 R350CDi

Hmmm. Higher per capita than France (which is supposedly near bankrupt) and Greece?

- Joined

- May 12, 2005

- Messages

- 2,634

- Reaction score

- 311

- Location

- Surrey/Cotswolds

- Website

- www.comand.co.uk

- Your Mercedes

- A150 manual, smart forTwo, W205 AMG line premium plus.

Hmmm. Higher per capita than France (which is supposedly near bankrupt) and Greece?

But the per capita figure bears no relation to the economy and/or its ability to sustain that level of debt. Its just a number divided by the population count, thats all. Its as valid as saying divide it by the number of cows in a field.

d215yq

Senior Member

- Joined

- Mar 28, 2008

- Messages

- 2,664

- Reaction score

- 702

- Age

- 39

- Location

- Valencia, Spain

- Your Mercedes

- 1987 W124 300D 280k miles

These figures are just government debt. Add in household debt and UK is actually higher than most as % of GDP (even Greece by many measures).

When the crisis hit here in Spain the government debt went up but pretty much overnight people who ate out 5 times a week did so once, new leased cars were sold and not replaced (many went from brand new car to no car). Yes the economy went into recession and old mortgages still exist but atleasat personal debt isn't rising and people have learnt their lesson.

This clearly has not happened in the UK. Car leases, credit card debt and mortgages at record levels and growing year on year. I'd say UK is far from as stable as it claims. I worry less about my euros in Spanish investments than pounds in UK investments...and I never thought I would hear myself say that!!!

When the crisis hit here in Spain the government debt went up but pretty much overnight people who ate out 5 times a week did so once, new leased cars were sold and not replaced (many went from brand new car to no car). Yes the economy went into recession and old mortgages still exist but atleasat personal debt isn't rising and people have learnt their lesson.

This clearly has not happened in the UK. Car leases, credit card debt and mortgages at record levels and growing year on year. I'd say UK is far from as stable as it claims. I worry less about my euros in Spanish investments than pounds in UK investments...and I never thought I would hear myself say that!!!

LostKiwi

Senior Member

- Joined

- Aug 25, 2006

- Messages

- 31,351

- Reaction score

- 21,612

- Location

- Midlands / Charente-Maritime

- Your Mercedes

- '93 500SL-32, '01 W210 Estate E240 (RIP), 02 R230 SL500, 04 Smart Roadster Coupe, 11 R350CDi

Yes to an extent but the population also determine the ability of the country to generate income to repay debt. In terms of GDP (income) per capita we are about the same as France ($42,481 vs $42,314) but well ahead of Greece ($26,669). Thats why Greece is in the smelly stuff but the UK and France not so much. Incidentally Germany is $48,111 and Singapore $87,855 (over twice as much income generated per capita as the UK)

davemercedes

Senior Member

- Joined

- Jun 15, 2012

- Messages

- 4,345

- Reaction score

- 2,099

- Location

- Glos

- Your Mercedes

- 2007 Merc 220 CDi Est Auto Av (s203)

IMO: The cost of interest is more important than the debt total and we hae no doubt been paying interest on interest for years.

Don't forget that since just after the Brexit vote we lost our 'coveted' AAA rating so we're presumably paying more interest. None of the Quit promoters said we were 'taking back control' that day! And recent comment from S&P suggested it 'may' be lowered further if feedback from negotiations is not good => higher interest.

Also, due to the pound on the currency markets (which those 'in the know' tell us: 'Don't worry, currencies go up and down all the time) any debts owed in US Dollars etc are costing at least 15% more (both the principal repayment and the debt).

Don't forget that since just after the Brexit vote we lost our 'coveted' AAA rating so we're presumably paying more interest. None of the Quit promoters said we were 'taking back control' that day! And recent comment from S&P suggested it 'may' be lowered further if feedback from negotiations is not good => higher interest.

Also, due to the pound on the currency markets (which those 'in the know' tell us: 'Don't worry, currencies go up and down all the time) any debts owed in US Dollars etc are costing at least 15% more (both the principal repayment and the debt).

Last edited:

davemercedes

Senior Member

- Joined

- Jun 15, 2012

- Messages

- 4,345

- Reaction score

- 2,099

- Location

- Glos

- Your Mercedes

- 2007 Merc 220 CDi Est Auto Av (s203)

Carney (BOE) has just warned the banks to top their balances because of anticipated bad debts.

https://www.theguardian.com/busines...-to-hold-more-capital-as-consumer-debt-surges

The average household debt - excluding mortgages is now £13000 (TUC - Jan 2017)

http://www.bbc.co.uk/news/business-38534238

A credit crunch is highly likely according to a few finance articles on the web. If that happens a lot of the cheap deals like PCP on cars are in danger of being shut down or going up in price quite considererably which will really hurt the auto trade at home.

https://www.theguardian.com/busines...-to-hold-more-capital-as-consumer-debt-surges

The average household debt - excluding mortgages is now £13000 (TUC - Jan 2017)

http://www.bbc.co.uk/news/business-38534238

A credit crunch is highly likely according to a few finance articles on the web. If that happens a lot of the cheap deals like PCP on cars are in danger of being shut down or going up in price quite considererably which will really hurt the auto trade at home.

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

IMO: The cost of interest is more important than the debt total and we hae no doubt been paying interest on interest for years.

Don't forget that since just after the Brexit vote we lost our 'coveted' AAA rating so we're presumably paying more interest. None of the Quit promoters said we were 'taking back control' that day! And recent comment from S&P suggested it 'may' be lowered further if feedback from negotiations is not good => higher interest.

Also, due to the pound on the currency markets (which those 'in the know' tell us: 'Don't worry, currencies go up and down all the time) any debts owed in US Dollars etc are costing at least 15% more (both the principal repayment and the debt).

I posted these in the Tories and Policy thread so I'll put them up again.

Interest first.

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

d215yq

Senior Member

- Joined

- Mar 28, 2008

- Messages

- 2,664

- Reaction score

- 702

- Age

- 39

- Location

- Valencia, Spain

- Your Mercedes

- 1987 W124 300D 280k miles

Back in the depression after the war there was not a global financial system and governments agreed loan deals between each other behind closed doors and speculation was nowhere near what it was now. Just because we serviced a huge debt after WW2 does not mean we could in any way do it now. Also see my post re personal debt: who had credit cards and hire purchase in the 1950s.

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

Of course there was a global financial system. It might not be the one recognised today but that doesn't mean it didn't exist. Banks, Tongs, clearing houses, insurance houses were all linked by telegraph; stock markets were just as sophisticated but used blackboards and ticker tape.

In terms of loan deals, we had one main loan with the US which was definitely not agreed behind closed doors but openly debated in Parliament.

What makes you think that we could not service a huge debt now as we did then? Put into context we lost the economic output of the Empire because of the war and were forced to restructure our economy for that war. We then had to restructure it afterwards. We didn't have the NHS or social services as we do now so the economy was not as inherently resilient and productive as it is today; the time lost through sickness was around an order of magnitude greater than today for example.

I take your point with personal debt but we are not discussing that in this thread.

In terms of loan deals, we had one main loan with the US which was definitely not agreed behind closed doors but openly debated in Parliament.

What makes you think that we could not service a huge debt now as we did then? Put into context we lost the economic output of the Empire because of the war and were forced to restructure our economy for that war. We then had to restructure it afterwards. We didn't have the NHS or social services as we do now so the economy was not as inherently resilient and productive as it is today; the time lost through sickness was around an order of magnitude greater than today for example.

I take your point with personal debt but we are not discussing that in this thread.

d215yq

Senior Member

- Joined

- Mar 28, 2008

- Messages

- 2,664

- Reaction score

- 702

- Age

- 39

- Location

- Valencia, Spain

- Your Mercedes

- 1987 W124 300D 280k miles

Of course there was a global financial system. It might not be the one recognised today but that doesn't mean it didn't exist. Banks, Tongs, clearing houses, insurance houses were all linked by telegraph; stock markets were just as sophisticated but used blackboards and ticker tape.

In terms of loan deals, we had one main loan with the US which was definitely not agreed behind closed doors but openly debated in Parliament.

What makes you think that we could not service a huge debt now as we did then? Put into context we lost the economic output of the Empire because of the war and were forced to restructure our economy for that war. We then had to restructure it afterwards. We didn't have the NHS or social services as we do now so the economy was not as inherently resilient and productive as it is today; the time lost through sickness was around an order of magnitude greater than today for example.

I take your point with personal debt but we are not discussing that in this thread.

I wrote my thesis atleast part on this last year...apologies I didn't make myself clear; there was a global financial system, it did not have the derivatives nor complex interconnectedness we have today. It also did not have the speculation we have today. We have created a system in which price has become a function of price, which means that there is no equilibrium price and markets continue to fluctuate wildly and in some cases without reason. Yes it was interconnected and there were speculators before, but the level of both has grown exponentially over the past two decades making the whole thing rather more delicate.

It is this interconnectedness that means you CAN'T ignore personal debt even if we're not discussing it, because if people cannot afford their debt repayments, banks take a loss and then banks are bailed out and so therefore personal debt is effectively public debt when things go wrong.

The credit crisis was NOT caused by government borrowing but by personal borrowing going wrong and all of that became public debt overnight. It was exacerbated by the fact that public debt was already irresponsibly high so there wasn't much room to manouvre but had personal debt not become public debt overnight there would have been no problem and we would not be having this discussion.

The painful steps Spain and some other countries have gone through are the medicine that's required. Although people correctly point out the Euro being terrible for these countries by not allowing devaluation, atleast a correction has been forced. In the UK no correction has been allowed and devaluatuion/zero interest rates have been used to push record personal debt as this is the main driver of keeping the economy where it is. It can only lead to a bigger and larger crisis when the correction does come (unless someone magics up a way to real technological growth of 5% year on year for 10 years to get the economy to catch up with what's being spent).

At some point someone has to realise that spending on borrowing is unsustainable. This doesn't need to be a bad thing, most societies with less material wealth than the UK are happier, as long as it's managed well and fairly and expectations are managed it's fine. The obsession with GDP as the main form of success and happiness has been one of the biggest errors of the last 100 years. If I spend all my savings on some top of the range mercs and set them alight their cost (and that of the fire service to put them out) will go straight to positive GDP. If I keep my battered W124 and save the money to work less and in projects that are less well paid but beneficial to society/local community then GDP goes down...GDP is really just a measure of how quickly you can use up what are now ever increasingly finite resources, something that makes no environmental, economic sense nor brings any form of happiness to societies. What will cause unhappiness is the pretense that the economy can keep growing, borrowing can keep growing and then a sudden unexpected correction of epic proportions suddenly shattering everyones expectations without being planned for

d215yq

Senior Member

- Joined

- Mar 28, 2008

- Messages

- 2,664

- Reaction score

- 702

- Age

- 39

- Location

- Valencia, Spain

- Your Mercedes

- 1987 W124 300D 280k miles

Who are we in debt to? China, the IMF?

The system is so interlinked the answer is we won't know. There is so much debt being cut up and resold that it's not entirely obvious but the main holders are certainly in China. To not pay them though you'd have to set off a chain pof not paying banks in many countries which would mean the system grinds to a halt and collapses anyway.

Craiglxviii

Senior Member

- Joined

- Sep 6, 2015

- Messages

- 17,781

- Reaction score

- 7,426

- Location

- Cambs UK

- Your Mercedes

- 970 Panamera Turbo; W221 S500L AMG Line, C215 CL500, W251 R350L AMG Line, plus several more now gone

Who are we in debt to? China, the IMF?

http://www.dmo.gov.uk/documentview....ta-historical.xls&page=publications/quarterly

SL63 Mark

Senior Member

- Joined

- Oct 1, 2012

- Messages

- 4,540

- Reaction score

- 2,623

- Location

- The South

- Your Mercedes

- R231 SL63 AMG

Can I ask a question. What has happened to Japan ? Why are they so in debt ? They were the world's most successful economy for most of the 70s and 80s, look what Japanese competition did to our Western industries.

GAD was founded in 2009 where we developed bespoke ECU Remapping software for motorsport clients, moving forward, we have extended to road vehicles for both performance and economy,

contact GAD Tuninghttp://www.GADTuning.co.ukto discuss your requirements.